VPAS or the Statutory Scheme: stick or twist?

26.09.2022

In our previous article, we reported on the expected significant increase in the VPAS repayment percentage for 2023. In this article, we consider the other scheme for controlling the costs for the NHS in purchasing branded medicines (the Statutory Scheme[1]) and options available to pharmaceutical companies.

The steep increase expected under VPAS is compelling pharmaceutical companies to consider their strategy with respect to branded medicines and the merits of the two schemes available.

Analysis

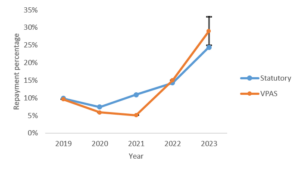

This graph depicts how the repayment percentages under each scheme have varied since VPAS was introduced in 2019 and includes the predicted VPAS repayment rate for 2023 which, based on forecasts, is expected to be 25-33%.

As noted in previous articles, a fundamental difference between the two schemes is that VPAS contains an algorithm for calculating the payment percentage for each calendar year based on the previous year’s sales while the Statutory Scheme percentages are baked into the legislative text.

The government regularly tweaks the repayment percentages under the Statutory Scheme to ensure that they reflect the observed growth of NHS spending on branded medicines. In June, the Statutory Scheme was amended to increase the repayment percentages for 2022 and 2023: the 2022 repayment percentage was increased to 14.3% (from 10.9%) and the 2023 percentage was set at 24.4%.

The VPAS algorithm would have generated a repayment percentage for 2022 of 19.1%. However, in January 2022, a one-off adjustment to the VPAS payment percentage effectively reduced this to 15% for 2022 while deferring the remaining 4.1% to 2023.

The cumulative effect of this deferral and the continuing growth of NHS spending on branded medicines means that it is anticipated that the VPAS repayment rate for 2023 will be somewhere between 25% and 33%, in excess of the 24.4% rate under the Statutory Scheme.

Strategy

The 2023 VPAS repayment percentage is forecast to be higher than the 2023 repayment percentage under the Statutory Scheme despite the permitted growth rate under VPAS being higher than that under the Statutory Scheme (2% vs 1.1%). As a result, some pharmaceutical companies may be considering whether to remain in VPAS for its final year[2]. This decision is complex and involves weighing the incentives VPAS offers against the ballooning repayment rate.

The key incentives available under VPAS are freedom of list pricing for New Active Substance medicines and various exemptions for medium-sized companies. These are not available under the Statutory Scheme. Companies who can’t take advantage of these incentives in 2023 may be tempted to jump out of VPAS across to the Statutory Scheme.

This approach provides no guarantee, as it is likely that the Statutory Scheme will be amended again to increase the repayment percentage for 2023. When amending the 2023 rate to 24.4% in March 2022, the DHSC specifically acknowledged that this was in response to their realisation that there was an incentive to “game the system” by hopping between the schemes.

Apart from hopping between the schemes, there may be other potential mitigating actions that companies can take to reduce the impact of high repayment percentages. VPAS and the Statutory Scheme only apply to branded medicines, as such companies may be tempted to de-brand their products, though this does risk losing the equity associated with the brand name. This would take these sales outside the scope of either VPAS or the Statutory Scheme. Companies considering taking this course of action will also need to weigh up the risk of the Secretary of State using her broad powers in the National Health Service Act 2006, which include a general power to control the price of any medicine used in the NHS. The powers under which the Secretary of State set up VPAS and the Statutory Scheme could also, in principle, be used to institute equivalent schemes for non-branded medicines.

Conclusion

Although the forecast 2023 VPAS repayment percentage seems set to be higher than the current 2023 repayment percentage under the Statutory Scheme, it is very likely that the Statutory Scheme will be amended accordingly. As such, it is unlikely that there will be a significant difference between the repayment percentages under each scheme. Both schemes are likely to prove punishing for companies selling branded medicines to the NHS in 2023. Industry will push to ensure that this malfunctioning repayment mechanism can be addressed in the next voluntary scheme which is due to start in 2024.

——

[1] As set out in The Branded Health Service Medicines (Costs) Regulations 2018.

[2] We note that the deadline for opting-out of VPAS falls at the end of this month.

Alex Denoon

Author

Hugo Kent-Egan

Author