VPAS – If you thought 15% was a shock, get ready for 30%!

21.09.2022

In an article published earlier this year we reported on growing dissatisfaction with the primary scheme designed to control the price at which the NHS purchases branded medicines: the 2019 Voluntary Scheme for Branded Medicines Pricing and Access (VPAS).

The main concern is the significant post-pandemic jump in the repayment percentages under VPAS. This repayment percentage is part of an affordability mechanism under which manufacturers and suppliers pay rebates to the DHSC for sales of branded medicines that exceed the permitted growth rate under the scheme of 2%.

NHS spending on branded medicines has continued to grow significantly above the permitted growth rate in 2022. Accordingly, the VPAS repayment rate for 2023, the final year of the scheme, will be unprecedentedly high. The current best guess is that the rate is likely to be between 25% and 33%.

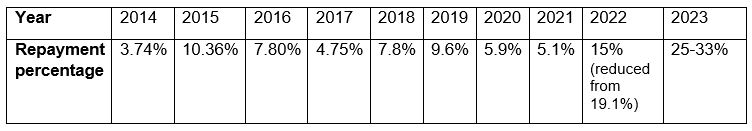

This compares with a repayment percentage that averaged around 7% between 2014 and 2021 under VPAS’ predecessor (PPRS) and VPAS, as shown in the table below.

Rebate percentages under PPRS or VPAS

In 2022, the repayment percentage skyrocketed to 19.1%, which at the time was attributed to the unprecedented effects of the COVID-19 pandemic. At the start of the year, the DHSC acknowledged this and agreed to cap the 2022 rate at 15%, with the remaining 4.1% being deferred to 2023.

Based on current forecasts, the 2023 rate is predicted to be around 30%. It is clear that the model that underpins VPAS is delivering unexpected and difficult outcomes for the sector.

Alex Denoon

Author

Hugo Kent-Egan

Author