Proposed review of the statutory scheme: a sign of things to come in VPAS?

15.08.2023

The Department of Health and Social Care (DHSC) recently announced a consultation for a review of the statutory scheme for branded medicines (the ‘Statutory Scheme’). The proposed amendments (1) increase the allowed growth rate under the Scheme; (2) add new exemptions, including one for new active substances; and (3) introduce a lifecycle adjustment mechanism to control spending on older branded medicines.

Discussions are ongoing with industry to agree a successor to the current voluntary scheme (the 2019 VPAS agreement), and the press release notes that the Government may amend details of the proposals to improve alignment with any agreed voluntary scheme. This suggests the proposed changes are indicative of the terms which the Government wants for any new VPAS. Indeed, the announcement emphasises that there has generally been broad commercial equivalence between the two schemes and that should a successor to VPAS be agreed, the two schemes should continue to work in a complementary way. If approved, the changes to the Statutory Scheme will apply from 2024 to coincide with any new voluntary scheme.

The consultation also gives some insight into the Government’s ideas about a successor to VPAS. We summarise the key proposals below and, where relevant, its interrelationship with VPAS.

Allowed growth rate increased from 1.1% to 2% to align with that currently offered under VPAS

The DHSC plan to increase the allowed growth rate under the Statutory Scheme from 1.1% to 2% per year to align with that currently offered by VPAS. In doing so, the DHSC acknowledged that the majority of sales have been governed by VPAS since 2019; thus, maintaining the lower rate would result in an effective decrease in allowed growth for most companies. This strongly suggests the allowed growth rate will not increase, or increase only marginally, under any new VPAS.

Exemption for new active substances

The Government proposes to add a number of exemptions that already exist under VPAS to the Statutory Scheme to ensure companies can continue to benefit if no new VPAS is agreed. Notably, this includes an exemption for sales of medicines containing new active substances (NAS). The exemption from payment will apply for 36 months from the date of the medicine’s first MA, with the payment percentage for remaining sales under the Scheme scaled to keep total net sales growth at 2%. This also strongly suggests that the new VPAS will maintain the 36 month exemption for medicines containing NAS.

Other proposed exemptions include that for centrally procured vaccines and exceptional central procurements.

Proposed payment percentages

The Government has tabled payment percentages for the years 2024 – 2026, both with and without the life cycle adjustment (LCA) (discussed in more detail below).

In effect, if the LCA is not implemented, the repayment rates will be:

| 2024 | 2025 | 2026 |

| 21.7% | 23.7% | 26.6% |

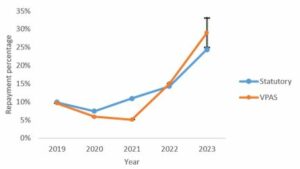

These rates are much higher than historical rates (which averaged at 9.4% between 2019 and 2021), as evident in this graph from our previous article on the Statutory Scheme that depicts how the repayment percentages under each scheme have varied since VPAS was introduced.[1] These rates are also much higher than industry had proposed under a new Voluntary Scheme for Pricing, Access and Growth (VPAG) to replace VPAS – namely 6.88%, albeit with an additional premium of 1.5% to be paid into a life sciences ‘investment facility’.

If the statutory scheme includes the LCA, then the percentages will be:

| 2024 | 2025 | 2026 | |

| Newer products (headline payment % ) | 9.7% | 11.1% | 15.4% |

| Older products with competition (lower payment %) | 10% | 10% | 10% |

| Older products with low competition (supplementary payment %) | 36% | 38% | 40% |

Life cycle adjustment

The biggest change proposed by the DHSC is the introduction of a life cycle adjustment (LCA) mechanism, which intends to address a perceived imbalance caused by a lack of competition for some older branded medicines.

Underpinning the rationale is the DHSC’s idea of the ‘innovation paradigm’, whereby new medicines are expected to achieve higher prices on launch but lower once there is competition from generics and biosimilars. This balance enables the NHS to support innovation while achieving value and improving net health gain overall. In practice however, the DHSC considers that a number of older products do not face sufficient competition to reduce prices and continue to be sold at a high price.

The LCA proposes to counter this by imposing a higher ‘supplementary’ payment percentage on older products in markets where there is little or no competition. Older products in more competitive markets will benefit from a lower payment percentage (a 10% flat rate).

The proposed exemptions, including the NAS exemption, will run alongside the LCA mechanism if both are adopted.[2]

Defining market competitiveness for older medicines

An ‘older’ product is any product where the active substance has been marketed in the UK for 12 years or more from the date of first MA for a medicine containing that active substance. All other products (i.e. those containing active substances which have been marketed in the UK for less than 12 years) will be deemed ‘newer’ products.

A ‘competitive’ market is any market where no single company (or group of companies) controls more than 80% market share in the UK. Market share is measured at virtual medicinal product (VMP) level and is based on the share of total sales quantity rather than sales value. To make this determination, the DHSC will collect suppliers’ quarterly sales data at individual presentation level.

Commercial arrangements will also be taken into account, and any market where two or more companies control more than 80% of the market via a commercial arrangement will be deemed not ‘competitive’.[3]

The consultation provides four examples of arrangements which it would not consider to be ‘competitive’ for these purposes:

- the same product is sold under different brand names by companies that are members of a single corporate group;

- the same product is sold by two unrelated companies under a licensing arrangement;

- two or more companies develop a product as part of a joint venture and market the product separately;

- one company sells a product and offers an inducement to another company to market a competitor product within the same market. This last scenario would appear to be highly unlikely in practice.

Product-specific rules

- New competitor products. The concept of a ‘new competitor product’ is introduced. These would be a branded generic (or a biosimilar version) of an older branded originator product launching in the UK under a new brand for the first time. New competitor products will benefit from the lower payment percentage for the first 12 months following its launch into an existing market.[4] After 12 months, companies will pay either the lower or supplementary rate depending on whether competition has been successfully established in that market.[5]

- Blood and plasma derived products. All blood and plasma derived products will be subject to the lower payment percentage, regardless of the level of competition in the market.

- Small molecule medicines. Non-biological (small molecule) medicines that are branded by choice will be subject to the supplementary rate, notwithstanding the level of competition in the market.

The DHSC have also clarified that the Statutory Scheme will apply to all biological medicines (branded and non-branded).

Outlook

The reaction to the consultation from industry has been mixed. On one hand, originator companies consider the proposals to be counter to the Government’s aim of making the UK a life sciences superpower and claim the proposal will stifle competition and discourage investment. Not only do they consider the rates to be very high, but the proposed differential rebates and the LCA are criticised for being impractical since a product’s relative age and competitiveness in the market can be very difficult to determine and change over time.

In contrast, producers of generic medicines have praised the LCA for being ‘pro-innovation’ in light of the lower rates for originator and new competitor products. This, in their view, encourages the launch of new medicines in the UK and lessens inequity caused by having a single rebate rate.

As several of the changes simply align the Statutory Scheme with the current VPAS, and the Government emphasises that there has always been broad commercial equivalence between the two schemes, it is easy to assume that the proposals are indicative of the terms to which Government are willing to agree for a new VPAS. In this regard, the ABPI called out the Government for consulting before talks on a new VPAS have progressed, which it views as being ‘highly prejudicial’ to the outcome of the negotiations. In any event, the consultation makes clear that the amended Statutory Scheme will act as a contingency if negotiations with industry fail.

The consultation is now open and will run until 10 October 2023.

============================================

[1] The graph includes our earlier prediction of the 2023 VPAS repayment rate which, based on forecasts, was expected to be 25-33%. The payment percentage for 2023 has since been set at 26.5%.

[2] By way of illustration, a ‘newer’ product can benefit from a 3-year exemption from payments from the MA date pursuant to the NAS exemption. Following this, the product will be subject to the headline payment percentage from years 3 to 12 following MA grant. After 12 years, the product will be subject to one of two payment percentages (lower or supplementary) depending on the level of competition in that market.

[3] A ‘commercial arrangement’ is any arrangement (including an agreement, decision or concerted practice) between suppliers that relates to one or more product in scope of the LCA and which has as its object or effect the restriction, prevention or distortion of competition within the UK. As drafted, this suggests the commercial arrangement must be outright anti-competitive (and therefore unlawful under competition law principles) to fall under the definition. We do not think this can be correct.

[4] An ‘existing market’ is one where the originator product has been marketed in the UK for more than 12 years.

[5] This will cease to apply if products claim greater than 80% market share in their own right before the end of their first year.

Alex Denoon

Author

Vivien Zhu

Author